Want to be paid a yield just for holding your NFT?

No, we’re not talking airdrops (although what we are about to introduce will likely lead to one).

Tensor, the leading NFT marketplace on Solana (which has hit the #2 spot across all chains) recently launched their Price Lock feature which enables anyone to go long or short on a chosen NFT collection for just a 3% fee.

As is often the case, those who get rewarded the most are the market makers. If you lock up your NFTs for 7 days for people to bet on, you will earn up to 389% APY plus Tensor Rewards.

Let’s first briefly explain how Price Lock works, before locking up one of our own Bodoggos.

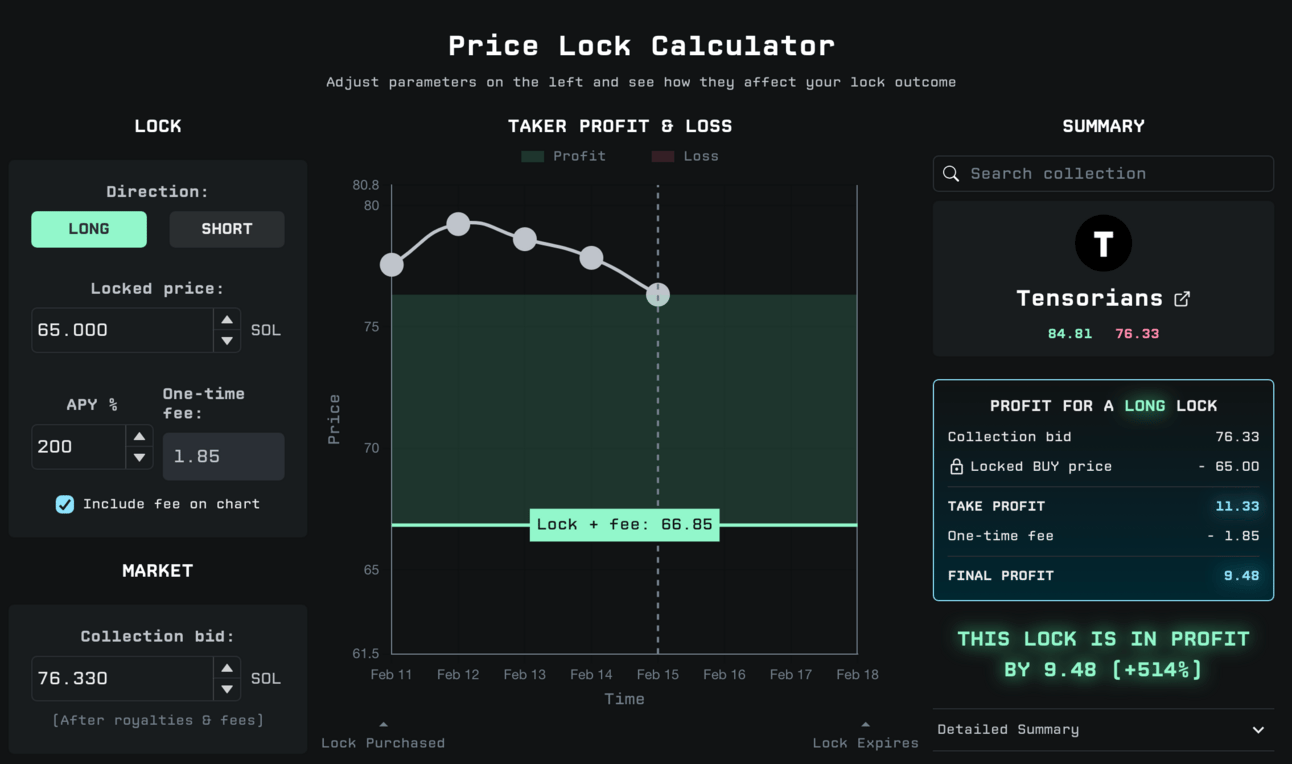

Going Long

To go long on an NFT you lock in your buy price.

Let's use Tensorians as an example.

If you'd been able to lock in your price at 65 SOL, right now you'd be up over 11 SOL by taking the collection bid. After the APY % fee for locking you make a 9.5 SOL net profit:

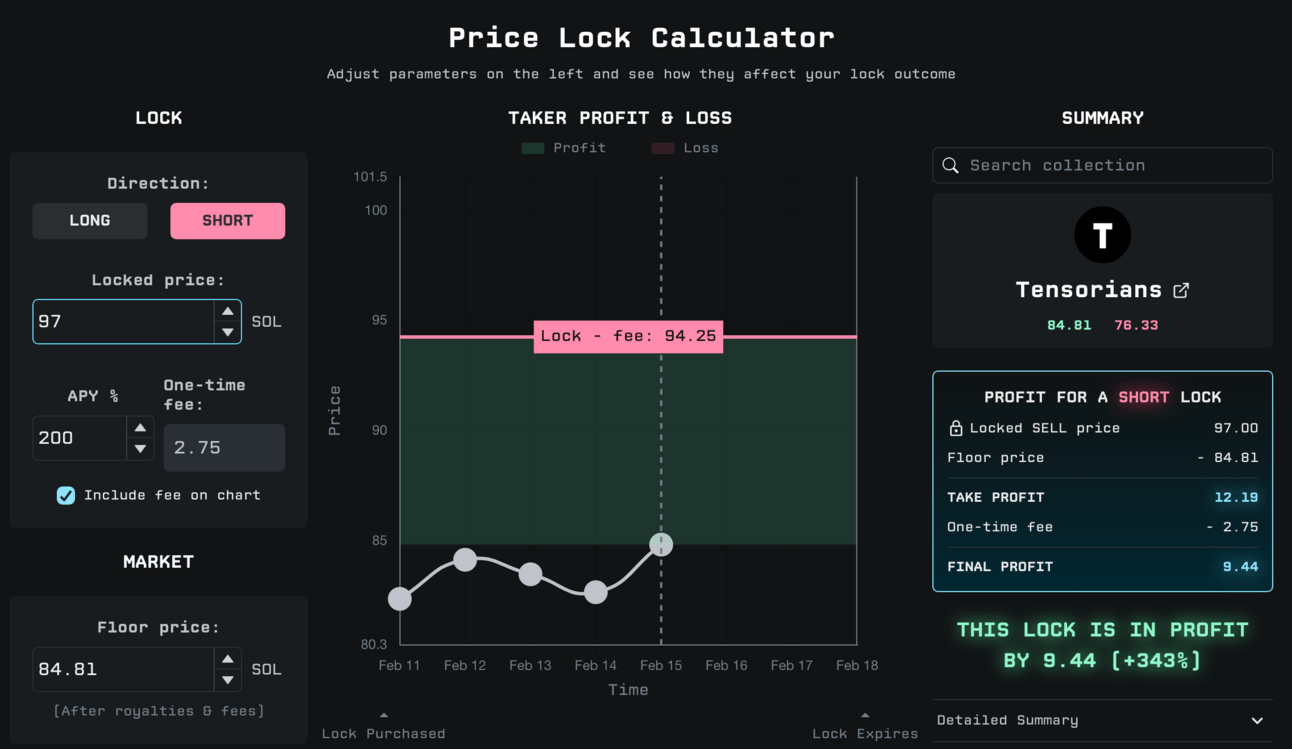

Going Short

And on the flip side, if you wanted to go short, you lock in your sell price.

If you'd been able to lock in a sell price at 97 SOL, right now you'd have the same profit as in the long lock example:

You can play around with the lock calculator for yourself here.

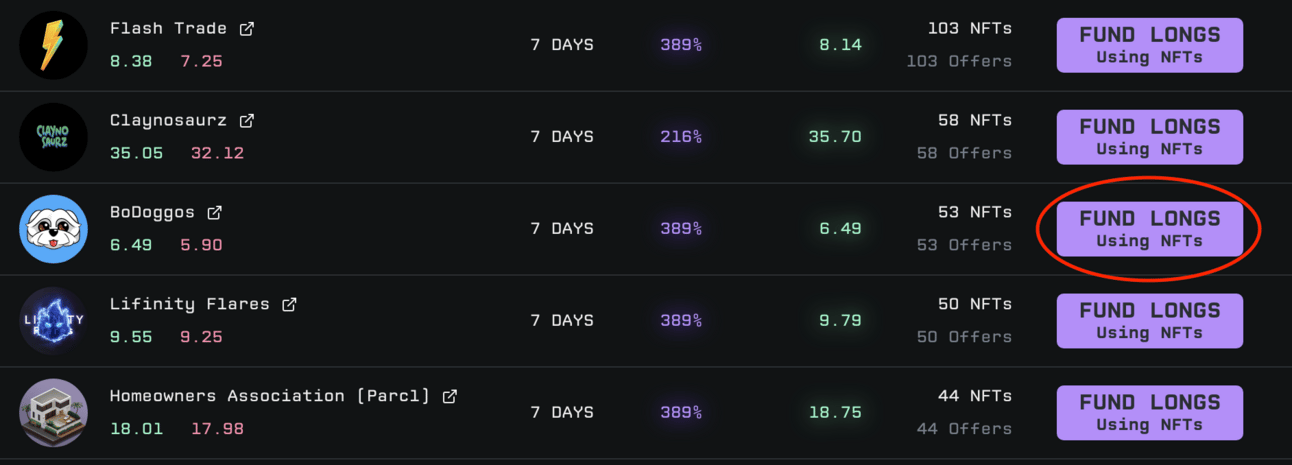

Funding Price Locks

Ok let’s go lock up one of our dogs. Think of it like a four-star kennel.

Step 1

First you head to tensor.trade/lock/fund and select one of now 19 different collections available.

As you may imagine, we’re bullish on Bodoggos so we’re going to be funding a long lock in this example:

As you can see above, there are currently 53 offers (dogs locked up) for someone to choose from.

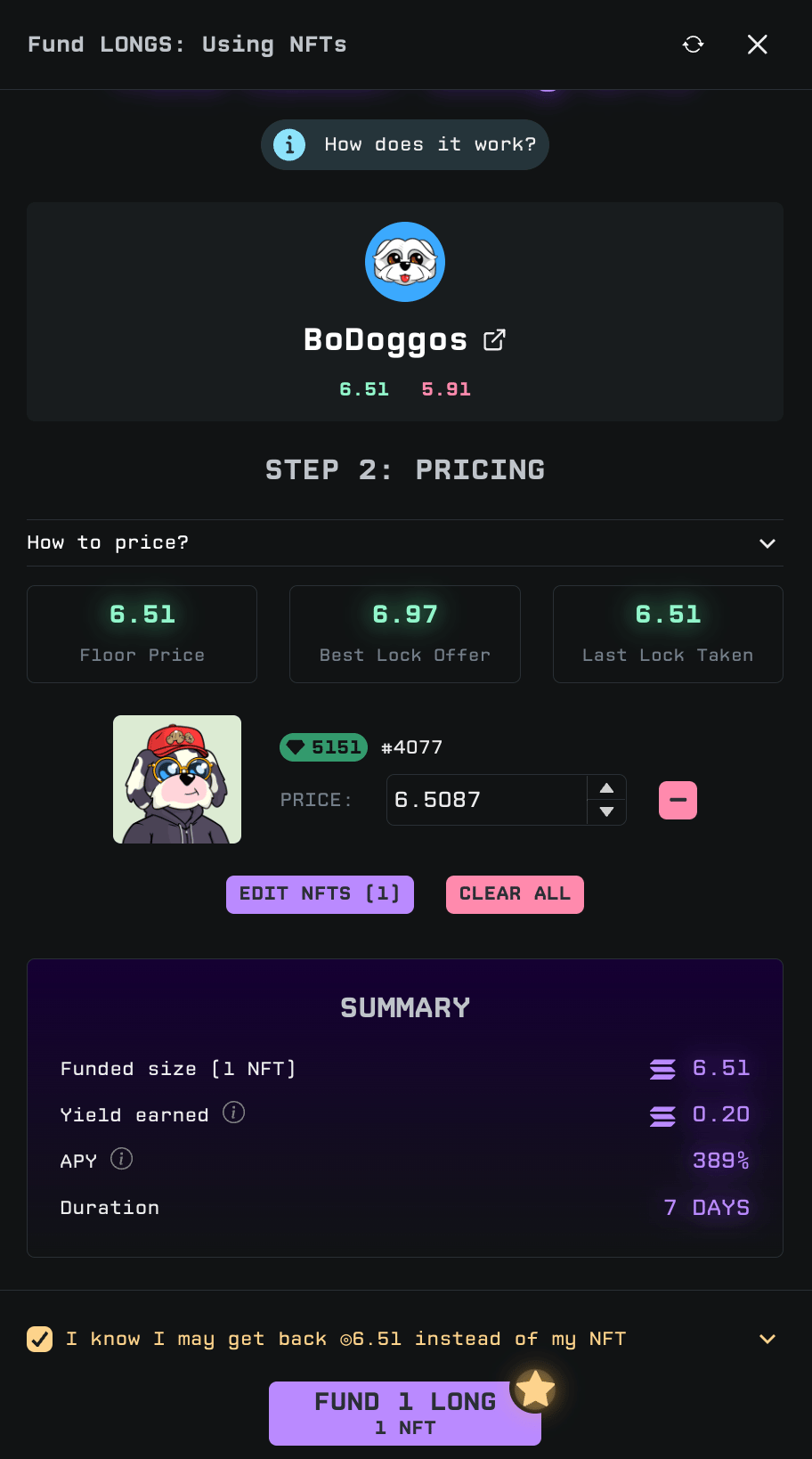

Step 2

Next you select one of your NFTs to lock up and choose the price for the lock:

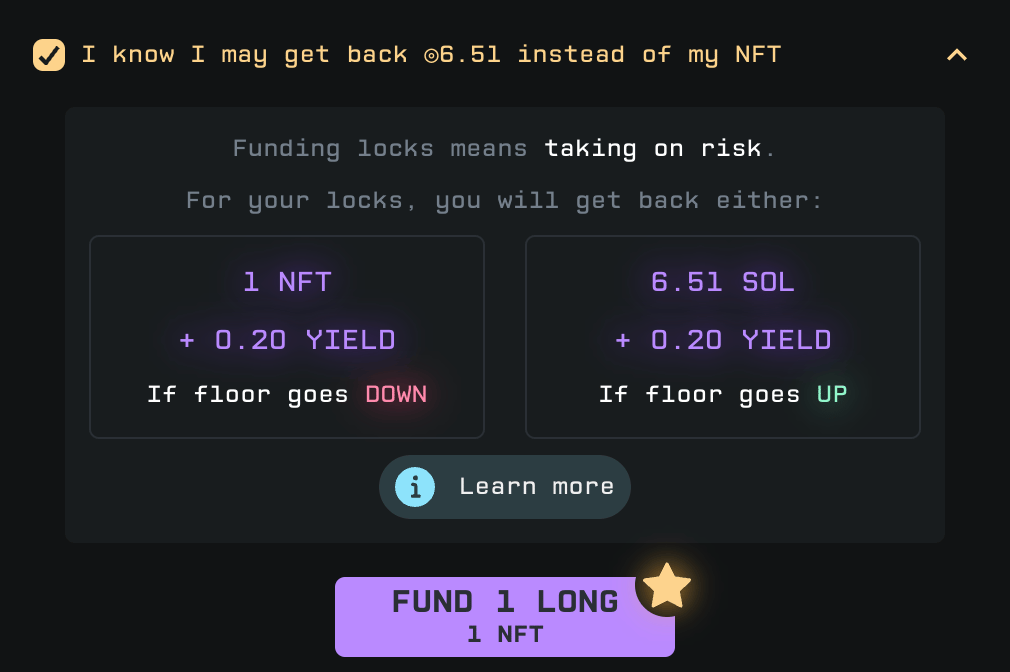

When funding long locks, if the price goes up, the taker will buy your NFT for the locked price you set, and you will receive this price back in SOL:

Once your lock is purchased, if the price goes below your long-locked price, you will get back your NFT and yield.

Choosing a higher price reduces your risk, but makes it less competitive for someone to choose your lock.

All locks have a fixed duration of 7 days, and you can only cancel a lock before someone purchases it.

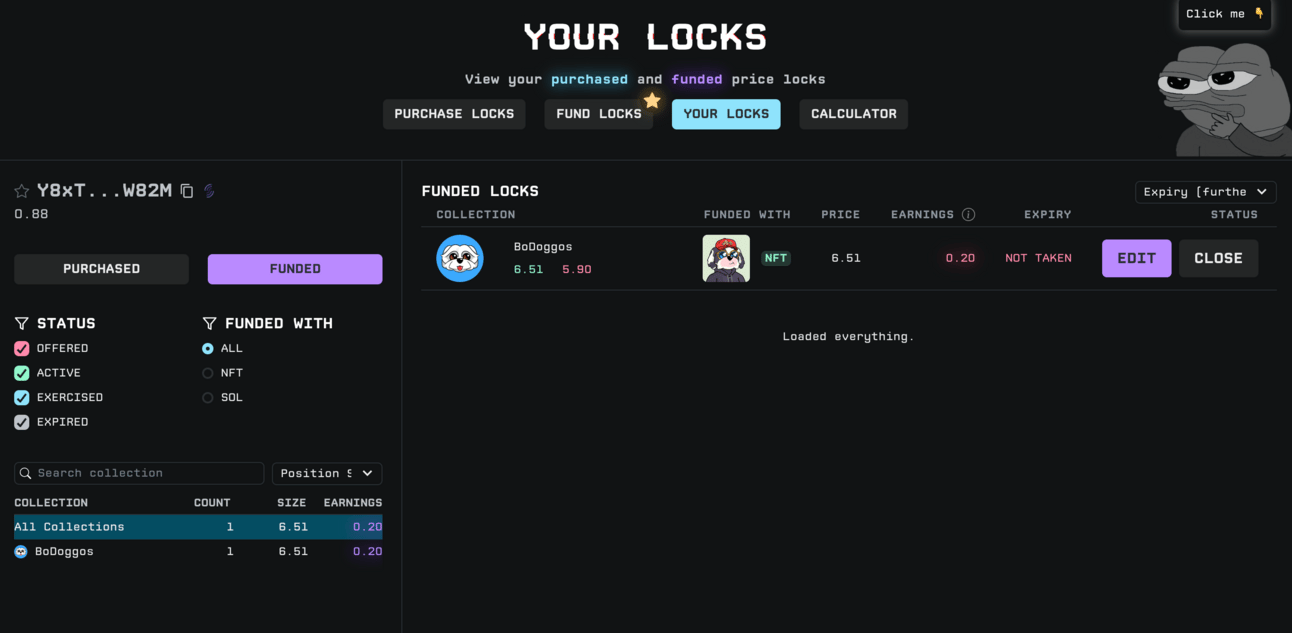

Once you have funded your lock, you can see the details in the Your Locks tab:

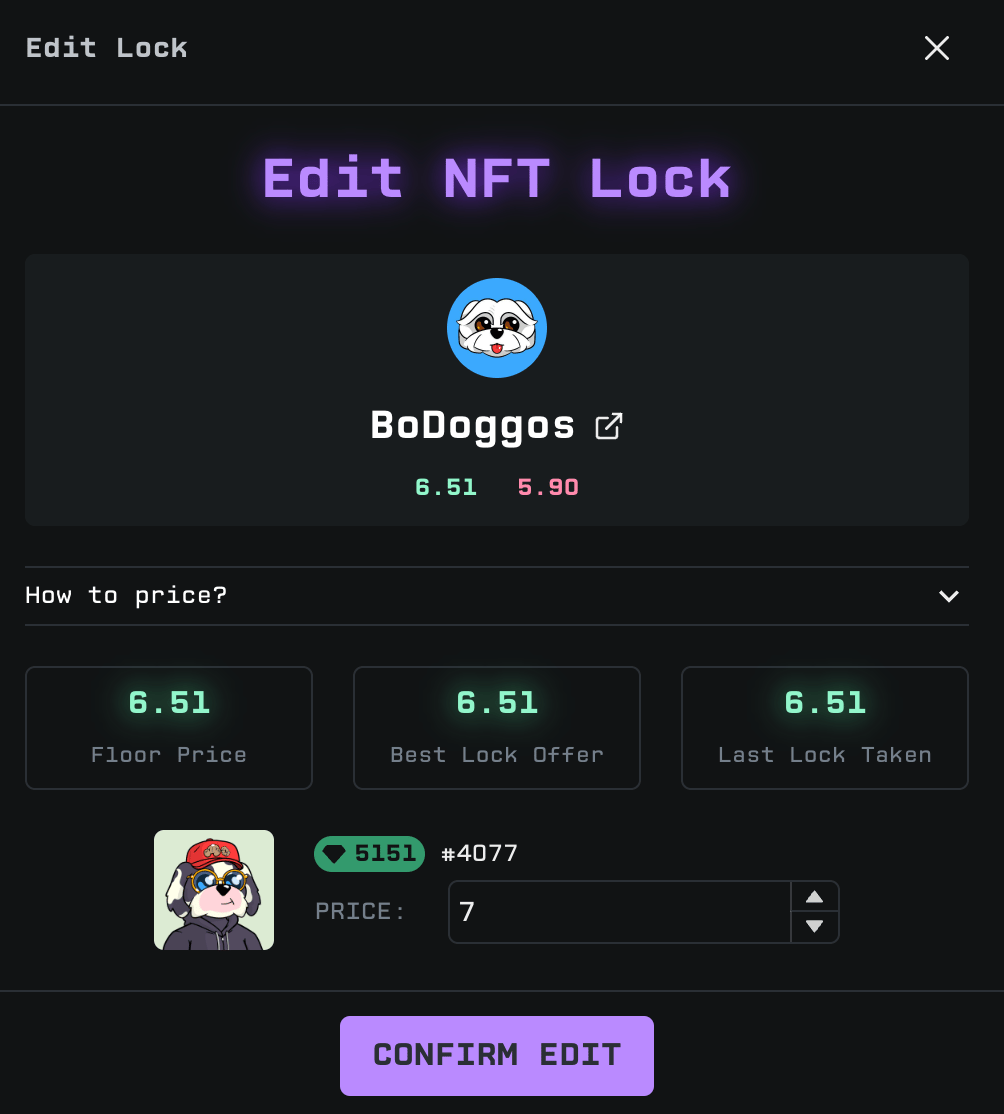

And you can edit the price (or cancel the lock) at any point until the lock gets purchased:

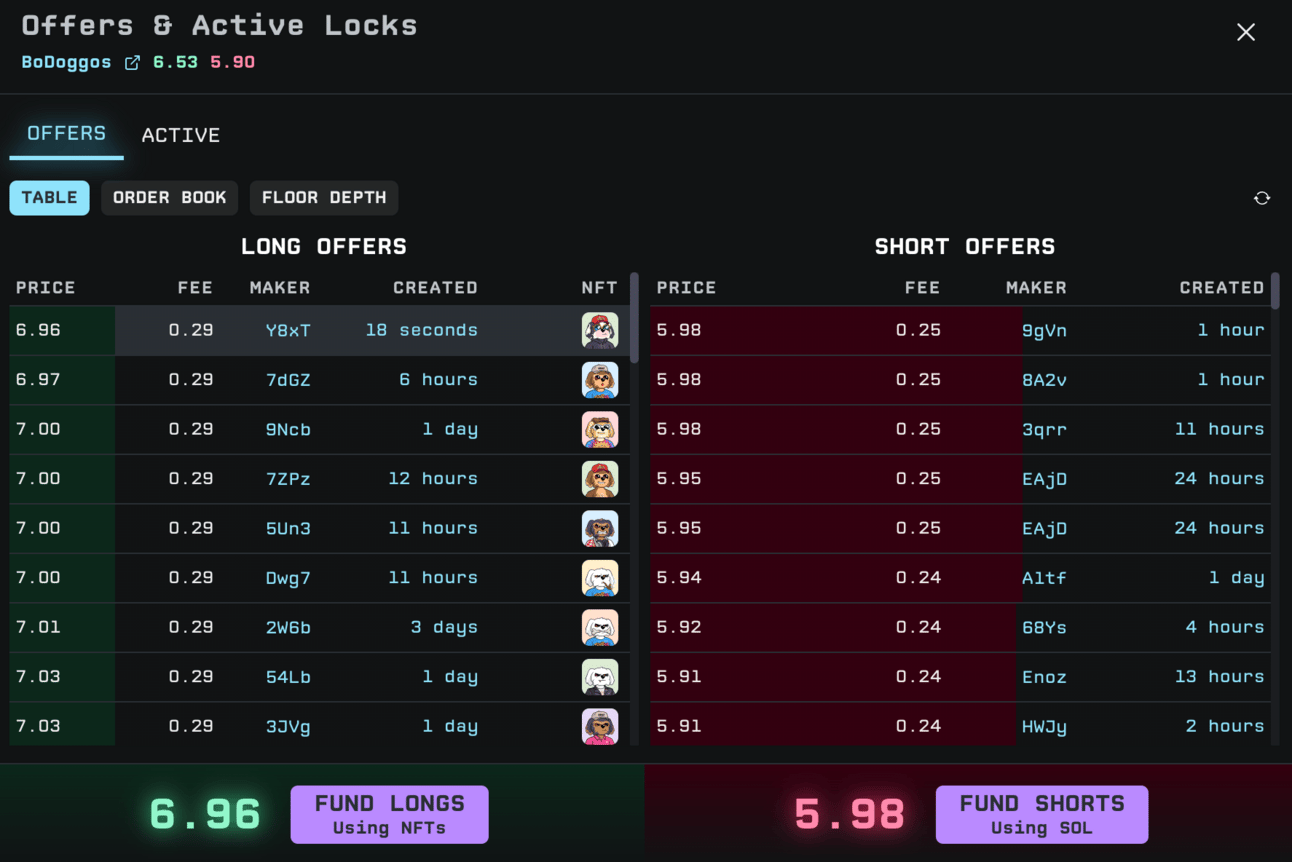

We moved the price down to 6.96 SOL to make it the top long offer, as can be seen in the Offers and Active Locks tab:

As soon as the offer is taken, you immediately earn your APY and Tensor Rewards.

Conclusion

Never before has there been a way for takers to go long or short for such a small fee. In the case of Bodoggos you can control a 6.5 SOL asset for as little as 0.25 SOL fee.

And as makers, we can earn yield on our dogs, as well as earn Tensor Rewards.

Sounds like a good deal for everyone.

!woof